What the Hell Really Happened to Sports Illustrated AND Can SI Stage a Comeback?

Sports Illustrated (SI) has been in the press a lot lately.

'The Depressing Fall of Sports Illustrated Reveals the Real Tragedy of AI'

‘“The Worst That It’s Ever Been”: Inside Sports Illustrated’s Winter of Discontent’

'How the World's Greatest Sports Magazine Was Reduced to Nothing'

The articles are endless. It even reached CNBC and the television networks.

You wanna know the real story?

At the outset, one thing to remember: media loves talking about other media. Media also loves trashing other media. It's the nature of media.

So the dozens of articles all have their own 'slant,' their own opinion, their own 'prism.'

But none of the writers of these articles really know what happened.

My former company Meredith Corp owned SI.

For over two years, I spent time almost every day with SI's leaders and staff, its business operations, its financial situation, its struggles, its problems, its turmoil.

I also led the sales process for SI and ultimately its acquisition by Authentic Brands Group (ABG).

With all the recent press attention, I thought I'd provide an 'inside' perspective: what the hell really happened?

Here goes:

1. The Storied History of SI

Through out modern culture, there were few more storied and iconic media brands than Sports Illustrated. As I talk about in an earlier newsletter, we sold a few of the others: Time and Fortune.

A brief history:

SI was first published in August 1954. Founded by Stuart Scheftel. Scheftel was quite a golfer in his day. He played in the 1932 British Open, and was the only American who won the British boys golf championship. He and his brother once defeated the future King Edward VIII and all-time great Bobby Jones in a match play tournament.

King Edward was also a good golfer.

Courtesy of Popperfoto via Getty Images

He might have been better off keeping his (golf) balls in the middle of the British royalty ‘fairway,’ instead of sailing off with an American woman.

Courtesy of Hulton-Deutsch Collection/Corbis/Corbis via Getty Images

I’m just sayin!

Scheftel published the magazine from 1936 to 1942. He then sold the name to another company, which released Sports Illustrated in 1949. This version lasted only six issues before closing.

Enter Henry Luce, founder of Time and Life. Luce began considering whether he should resurrect Sports Illustrated.

Luce’s advisors tried to kill the idea. They snubbed their noses at sports, believing that it was beneath 'serious' journalism.

I devote an earlier newsletter to Ernest Hemingway. Hem loved sports. Almost every piece of his work included sports. Hemingway became one of SI’s most famous writers, publishing several pieces in the 1950’s.

You can buy the 1986 issue of SI featuring Hemingway.

In addition to Hemingway, some of the best writers of all time wrote for SI.

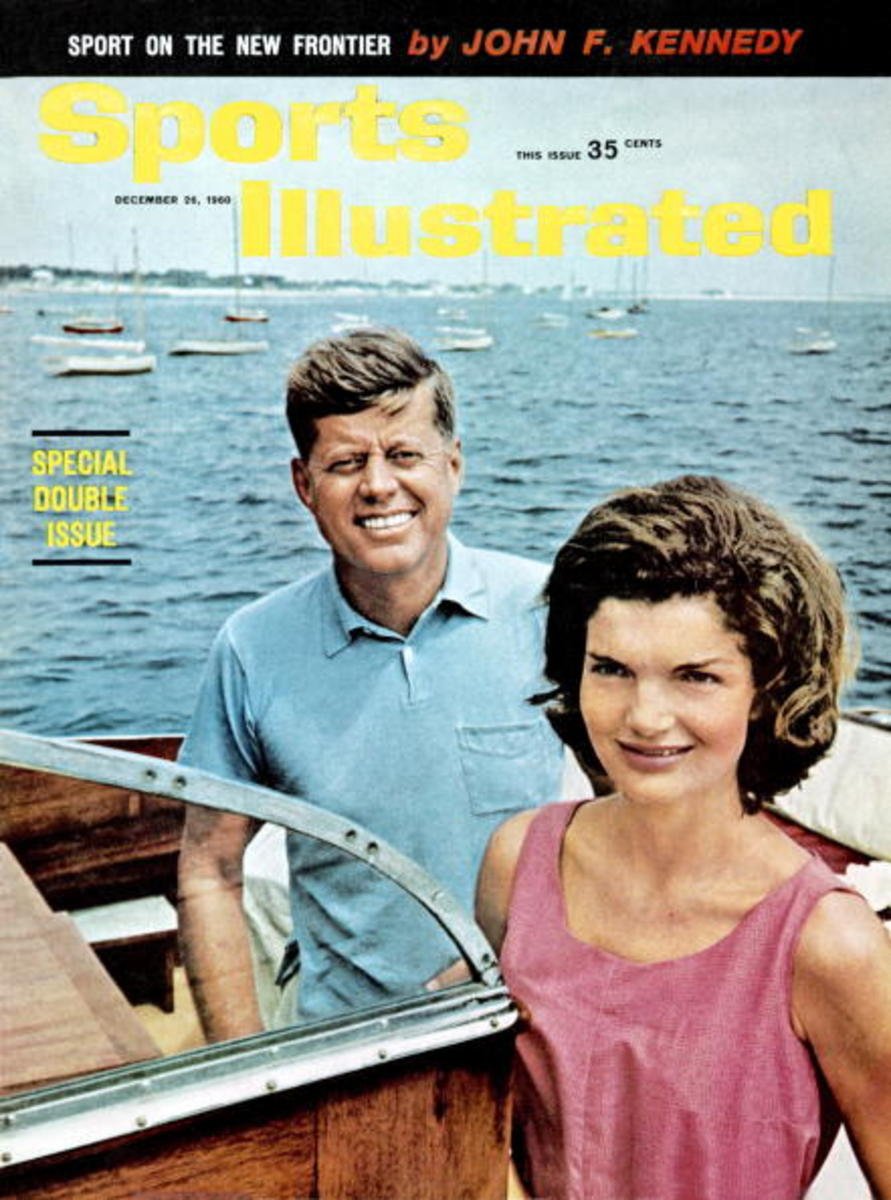

Even JFK wrote in SI to launch his 1960 campaign.

Courtesy of David Drew Zingg via Sports Illustrated

Luce was ahead of his time. SI launched in 1954, right before the popularity of spectator sports in the US was about to explode. During the 1960’s and 1970’s, this popularity was driven by television and Sports Illustrated.

SI became part of the weekly routine for millions of fans. They watched the games on the weekend, then waited for SI to arrive in the mailboxes the next week to tell them what had really happened behind the scenes. Growing up, I lived through these times with all of my friends and our dads.

James Michener writes about this in his great book ‘Sports in America’.

Sports in America by James A. Michener

SI continued to flourish into the 1980’s and 1990’s topping out at 3.5 million subscribers.

And of course there was the SI Swimsuit Issue. First published in 1964, it became the launch pad for supermodels.

The first swimsuit issue cover featuring Babette March

It also is credited with popularizing the bikini.

Photograph by Yu Tsai via Sports Illustrated

In later years, SI Swimsuit suffered an ‘identity crisis.’ Was it too ‘sexist?’

Photographed by James Macari via Sports Illustrated

Hmmm... probably so.

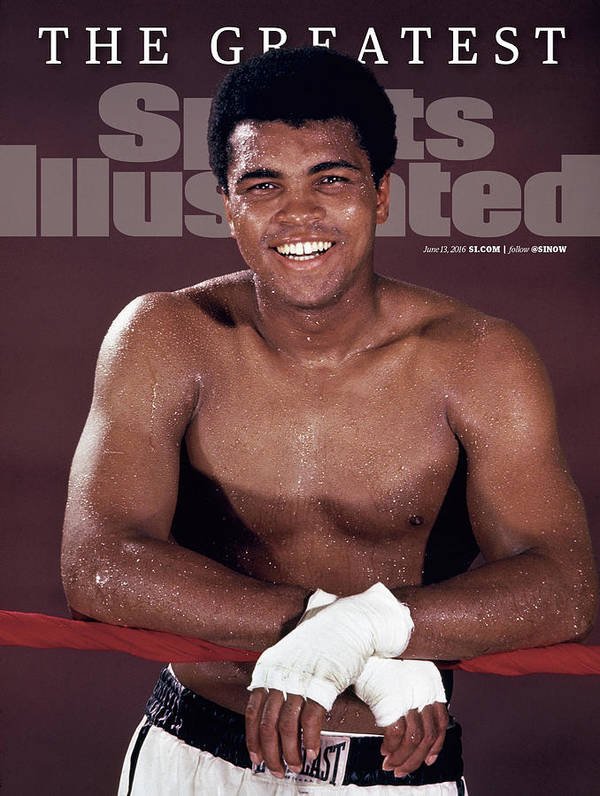

SI was part of the American fabric. Its covers were famous and were a window into the most important sporting events in history:

Photographed by Neil Leifer via Sports Illustrated

2. Buying SI

Meredith acquired Time Inc in March 2017 for $2.9B. So we ended up owning SI.

We might have paid too much for Time Inc. But our valuation case was based on three things:

We could achieve hundreds of millions in ‘synergies.’ A lot of this involved big layoffs - mostly of Time’s corporate staff.

We could improve the performance of Time’s businesses. For example, Time’s digital business had about $700 million in revenue, but made no profit. Meredith’s digital business had 20 percent operating margins. So we just needed to run Time’s digital business like ours.

Asset sales.

This is where I came in.

We knew we didn’t want to keep all the businesses that Time had.

After a portfolio review, we sold 15 businesses over 24 months. Some were digital businesses. Some international. Some iconic but challenged: namely SI, Fortune and Time.

All in, we raised about $1.3 Billion in cash proceeds.

Not too shabby.

There are 'truisms’ about media. One is media is full of blabber mouths.

Courtesy of JuhPrado via Tenor

Especially media people in New York.

So once we decided to sell these businesses, we knew there would be leaks.

So we said ‘F* it' and issued a press release.

There were a lot of investment bankers and ‘media consultants’ that we did not retain to sell the businesses. When seeing the press release some were happy to 'opine' to the press:

Meredith will never sell these businesses. 'It will be a busted auction.'

Well, we proved the naysayers wrong.

3. The Sales Process

It wasn’t too long after we got the keys to Time’s Headquarters at 225 Liberty that it became clear that it wasn’t going to be easy selling any of these businesses.

We knew about some of the issues. Many we did not.

First, we knew that Time Inc never kept income statements and balance sheets for its individual businesses. It kept revenue, but not separate income statements and balance sheets.

The only expense line was a $500+ million 'General & Administrative' account that covered all the businesses. This G&A account was a huge 'blob.' What was in there?

Courtesy of Jellygummies via Giphy

To successfully sell a business, you need to do several things.

You need to have income statements and balance sheets. Buyers like to see these things!

Courtesy of Spiderbat36 via Tenor

So we needed to do what’s called ‘carve out’ financials for the business.

Carve out financials are the equivalent to having a root canal… except your’e having a hundreds root canals!

Courtesy of www.simpsonsworld.com

Second, when you are selling a business, it’s difficult to change things.

You can’t streamline the business by centralizing functions into corporate overhead. Headcount needs to stay the same.

You pretty much have to keep the business separate and independent.

We did our best to manage and support these businesses.

But one thing is for sure: We did no damage to SI during the two years we owned it.

4. Selling SI

In an earlier newsletter I touched on the SI sales process in describing 'Five Toxic Business Types'.

We had significantly more 'preliminary' bidders on SI than any other business we were selling.

Around 75 separate groups.

We had a string of the typically dull private equity and hedge fund guys.

But we also:

Had NBA Hall of Famers

Courtesy of Malchey via Vector Stock

Hollywood Moguls

Courtesy of Jeremkin via iStock

World Famous Motivators

Courtesy of Mshirley27 via Comicvine

Big Time Talent Agents

Courtesy of Gary Brown via CartoonStock

NFL Hall of Famers

Courtesy of Gabriel Alexandre Meza via Behance

Okay someone other than Brady...

Hollywood Celebrities

Courtesy of Andrew Fyfe via www.Andrewfyfe.com

Okay someone other than Pitt and DeCaprio...

And we had a Clown Car.

Courtesy of LeanneFleetKruger via Tenor

'Clown Car' is a metaphor - this bidding group was not literally a 'clown car.' It just appeared as such - characters going in and out of the bidding group... like the GIF above.

You get the picture.

The problem with most of the SI bidders was twofold.

They either:

Low balled us on purchase price or

They bid an acceptable purchase price, but they wanted to use other people's money (OPM) to finance the deal.

As I describe in my earlier newsletter:

Beware of the buyer using OPM!

AKA - Toxic Business Type 4: 'Don't Worry, I Can Raise the Money!'

Courtesy of OfficiallyLatetotheParty via Tenor

We finally sold to Authentic Brands Group (ABG), a well-capitalized brand licensing company.

As part of the deal, we agreed to operate SI for up to three years.

We even agreed to pay ABG an attractive annual licensing fee so ABG was guaranteed a return.

We announced the deal in late May 2019.

5. The ‘Sh*T Show’ After

Things ran smoothly for a couple weeks...

We were heading off to our Aspen Food & Wine Classic in late June.

Courtesy of www.classic.foodandwine.com

We were flying one of our aircraft to the event. Martha Stewart hopped a ride with us as she was doing some cooking seminars.

I was really looking forward to a great couple days in beautiful Aspen.

Eat some great food, drink some great wine, hang with friends, take in the mountain air… You know, relax a little!

On the opening night, we had just arrived back to our hotel after a nice dinner event. It was about 10 pm Mountain time - midnight Eastern.

My iPhone was lighting up. I wondered 'Who the hell is calling me this late?'

Let me give two important tips here:

Be careful giving out your mobile number - unless necessary, never give it to anyone in business who might call you in the middle of the night.

When your phone rings, do NOT answer unless you want to talk to the person. You can always say later 'Hey sorry, my phone was off, had a bad connection' or whatever!

In this case, I had just closed the SI deal with these guys from ABG. So I had to give them my mobile number.

Against my second rule, I decided to answer my phone.

No good deed goes unpunished… why did I answer my phone?

It was the ABG guys.

'Hey John, we've decided to enter into a new licensing agreement with...'

It was ABG’s decision, and I respected that.

The press release went out the next morning.

For the record, this licensee subsequently changed its corporate name, its ownership and management. Accordingly, I make no comment regarding this company now.

The rest, as they say, is history...

As a bi-product of deals that go south, there are usually lawsuits.

Also an interesting “side bar”: if you’re a technology company, Artificial Intelligence (AI) is a good thing.

Look at these stock charts:

Much of the upside in these stocks is driven by the potential of AI.

But if you are a media company - be careful - AI might not be so good.

Tyler Perry recently put an $800M studio expansion on hold because of the media production potential of AI.

Tyler was also concerned about AI’s effect on media jobs. Media companies will grapple with this ‘AI media’ conundrum: What’s good? What’s not good? A thousand shades of gray…

Recently, Minute Media became the new publisher of SI. As I mention in a previous newsletter, we sold FanSided (a sports blog business) to Minute Media. Interestingly, FanSided was part of SI, but it made more sense to me to carve FanSided out and sell it separately.

So will there be a happier outcome for SI? I hope so...

Based on what I know about Minute Media, it might be a great digital platform for the SI brand. Minute Media has hired back some of the SI staff. This is encouraging.

Can SI stage a comeback? The key to successfully transforming a legacy media brand is twofold:

Building non-media revenue sources (e-commerce, licensing, sports gaming).

Maintaining a sustainable media business to support the brand.

SI will never return to its former glory. But it has a chance.

Just Say'in.

See you next time!